CLEAR THINKING

POWERFUL STRATEGIES | OUT OF THE BOX SOLUTIONS | CARING SERVICE

latest news, articles and tips

Thinking of making a tax-deductible donation? Looking for a succinct summary of the Budget?

For the latest news, articles and tips read on.

NSW Back Home Grants

The NSW Government has announced “The Back Home grant”, helping support renters and homeowners who were highly impacted by the February to March 2022 floods. Households that have been damaged or destroyed and are unable to claim for insurance or natural relief,...

Bank Assistance for Flood Impacted Customers

NAB Customer Flood Impacted Grants: NAB customers directly impacted by the current floods are currently able to receive initial support including $1,000 business grants to help restart or reopen and cover the cost of damaged property, equipment and for loss of...

NSW Disaster Recovery Allowance

The Australian Government is offering income support for people who have lost income as a direct result of the floods from February 2022. Applications are open and will close 3 September 2022. Eligible applicants are allowed maximum of 13 weeks and will get paid...

NSW Disaster Recovery Payment

The Australian Government has opened up a lump sum payment for people who were seriously affected by the floods from February 2022. Applications are open and will close 3 September 2022. Kyogle, Byron, Ballina, Lismore and Tweed are included for the disaster...

Tax Tip: Motor Vehicle Logbooks

It is important clients have up to date logbooks that are accurate to ensure they can make appropriate claims. Logbooks are valid for 5 years so please check whether a new logbook is required. If you have had a change in circumstances within the 5 year period, for...

2022 Small Business Support Program – NSW Government

The NSW Government is rolling out a new support grant to help with the impact that the current Omicron Covid-19 variant has caused to small businesses. The changes to the public heath orders during the end of 2021 and into early January have directly and...

Cryptocurrency

Record Keeping for Cryptocurrency You need to keep the following records in relation to your cryptocurrency transactions including: the date of the transactions, the value of the cryptocurrency in Australian dollars at the time of the transaction (which can be...

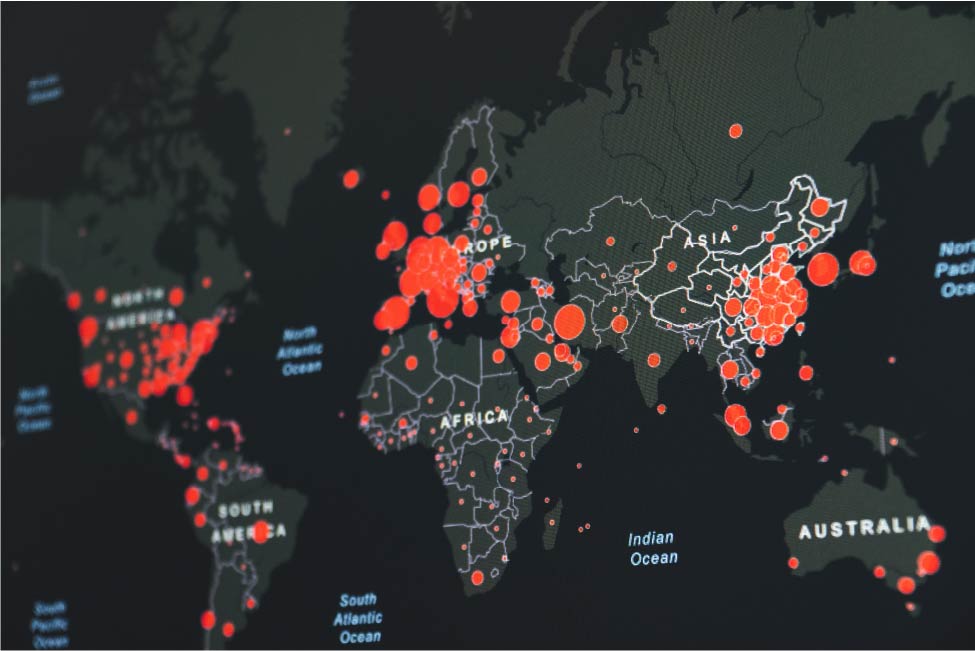

Can you be sued by your employee if they contract COVID-19 in the workplace?

With all restrictions due to end before Christmas, once 70% and 80% vaccination rates are reached, it is critical that employers ensure that their employees are not exposed to undue risk of contracting Covid-19. With the disease detected in the Tweed, now more than...

Tax Deductible Gifts and Donations

For your generosity to be a legitimate tax deduction, the donation needs to meet the following conditions: The recipient must have the status of Deductible Gift Recipient (DGR). If you are unsure of the organisation's DGR status, you can check it here:...

Party Time- Fringe Benefits Tax

In the next few weeks, many workplaces will be throwing their annual Christmas party for themselves and their employees. Nothing screams “Party!” quite like Fringe Benefits Tax legislation, so here’s a quick overview of the FBT rules for employers to keep in mind...

Jobs Plus Program

Jobs Plus is a program to generate new employment positions and provide tax relief and additional support for expanding businesses in NSW. The program is designed to support Australian and international companies looking to start or expand business operations in...

Winding up Covid-19 Support Payments

Covid-19 Disaster Payment: Once a state or territory reaches 70% full vaccination, automatic payments will cease and individuals will need to reapply each week to confirm a Commonwealth Hotspot remains in place. After the Hotspot reaches 80% full vaccination, the...

Rental Relief for Commercial Tenants

The NSW Government has reintroduced the Retail and Other Commercial Leases (COVID-19) Regulation 2021 (NSW) which provides mandatory rent relief to be negotiated between landlords and tenants under an impacted retail shop lease. An impacted lease is defined as a...

Queensland Government Funding

Federal Assistance From Saturday the 7th August there is a payment available similar to Jobkeeper called the Covid-19 Disaster Payment which you can apply for yourself through your MyGov account linked to a Centrelnk online account which is easy to set up. The...

One-Off Small Business Grants

COVID-19 Business Support Grants (Applications will open on 19 July 2021 and close at 11:59pm on 13 September 2021.) Grant funds can be used for business expenses for which no other government support is available. This can include utilities, wages, rent,...

Update: 2021 COVID-19 NSW Grants

>>>An update on the 2021 COVID-19 NSW Grants <<< New testing dates and alternative rules** now apply for businesses that do not meet standard eligibility criteria for the COVID-19 Business Grant, COVID-19 JobSaver Payment and COVID-19...

Budget Superannuation measures announced

The major Superannuation related measures announced in the Budget, includes the following:- Superannuation contributions work test to be repealed from 1 July 2022 As a result, individuals under age 75 will be allowed to make or receive non-concessional (that is...

Budget Summary 2021

The major tax-related measures announced in the Budget, includes the following:- Personal tax rates – there were no changes made to personal tax rates, the Government had already brought forward the Stage 2 tax rates to 1 July 2020. The Stage 3 personal income tax...

The End of JobKeeper – What Now…

The 31 of March saw the final period for which JobKeeper could be claimed. This will mean that many businesses will need to find additional cash flow to support the continuing employment of their current employees. The good news is that you may now be eligible...

JobKeeper Extension – Detailed Rules and Dates

To qualify for JobKeeper Extension 1 (fortnights beginning on or after 28th September 2020 and ending on or before 3rd January 2021), entities must satisfy both: The original decline in turnover test (extended to include the months of Sep to Dec and/or the quarter...